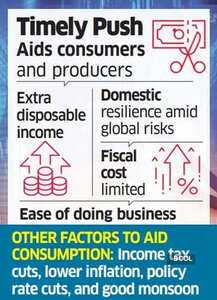

Domestic demand will get a boost after goods and services tax ( GST) rationalisation, economists said, providing support to the economy that’s seen likely taking a hit from the 50% duty levied on Indian imports by the US.

“At a time where consumption demand has been uneven and felt pressure from high inflation and low nominal wage growth over the last couple of quarters, the proposed GST reforms are a positive, especially for essentials, aiding consumption by the lower and middle income class,” said Sakshi Gupta, principal economist at HDFC Bank.

Simpler Slab Structure

QuantEco Research economist Yuvika Singhal said, “Any kind of reduction in taxes is positive for consumption as it leaves higher disposable income in the hands of consumers.” Prime Minister Narendra Modi had said in his Independence Day speech on Friday that GST reforms would provide relief to micro, small, and medium enterprises (MSMEs), local vendors and consumers.

The GST cuts on items will range from durables such as refrigerators and air conditioners to packaged foods and medical supplies.

“It's a much-needed development, and GST rationalisation is the need of the hour, apart from other reforms,” said Paras Jasrai, associate director at India Ratings and Research (Ind-Ra). The Centre has proposed that India move to a simpler, two-slab structure from four currently--retaining the 5% and 18% rates and scrapping the 12% and 28% levies, ET reported earlier.

“With indirect taxes having a wider reach, GST reforms can deliver a stronger boost,” said Gaura Sengupta, chief economist at IDFC First Bank. “Rural consumption is improving but not broad-based enough to offset weak urban demand, so a fiscal push was needed—and these reforms provide that.”

Local vs Global

Jasrai said that lower stabs and tax rates will give consumption demand a significant boost, especially amid the uncertainty over trade tariffs that are seen impacting external demand.

US President Donald Trump has imposed a 50% tariff on India, including a 25% penalty for importing Russian oil. The International Monetary Fund (IMF) and World Bank have cut global growth forecasts amid the prevailing trade uncertainty. Even so, India’s domestic strength will stand out.

“Since domestic consumption makes up a larger share of the economy, India will remain resilient despite global headwinds,” said Singhal. An increase in spending activity will also lift gross domestic product (GDP). The boost to nominal GDP growth is estimated at 0.6 percentage point over 12 months using fiscal multipliers, said Sengupta.

HDFC Bank’s Gupta said the reform could boost demand for consumer durables if GST rates on items such as ACs and TVs are reduced. “A more notable impact could also be seen for demand for two-wheelers and cars if the current GST rate of 28% is reduced to 18%,” she said.

Singhal highlighted that fast-moving consumer goods (FMCG) companies will see a positive impact, depending on how and when the changes are implemented.

“At a time where consumption demand has been uneven and felt pressure from high inflation and low nominal wage growth over the last couple of quarters, the proposed GST reforms are a positive, especially for essentials, aiding consumption by the lower and middle income class,” said Sakshi Gupta, principal economist at HDFC Bank.

Simpler Slab Structure

QuantEco Research economist Yuvika Singhal said, “Any kind of reduction in taxes is positive for consumption as it leaves higher disposable income in the hands of consumers.” Prime Minister Narendra Modi had said in his Independence Day speech on Friday that GST reforms would provide relief to micro, small, and medium enterprises (MSMEs), local vendors and consumers.

The GST cuts on items will range from durables such as refrigerators and air conditioners to packaged foods and medical supplies.

“It's a much-needed development, and GST rationalisation is the need of the hour, apart from other reforms,” said Paras Jasrai, associate director at India Ratings and Research (Ind-Ra). The Centre has proposed that India move to a simpler, two-slab structure from four currently--retaining the 5% and 18% rates and scrapping the 12% and 28% levies, ET reported earlier.

“With indirect taxes having a wider reach, GST reforms can deliver a stronger boost,” said Gaura Sengupta, chief economist at IDFC First Bank. “Rural consumption is improving but not broad-based enough to offset weak urban demand, so a fiscal push was needed—and these reforms provide that.”

Local vs Global

Jasrai said that lower stabs and tax rates will give consumption demand a significant boost, especially amid the uncertainty over trade tariffs that are seen impacting external demand.

US President Donald Trump has imposed a 50% tariff on India, including a 25% penalty for importing Russian oil. The International Monetary Fund (IMF) and World Bank have cut global growth forecasts amid the prevailing trade uncertainty. Even so, India’s domestic strength will stand out.

“Since domestic consumption makes up a larger share of the economy, India will remain resilient despite global headwinds,” said Singhal. An increase in spending activity will also lift gross domestic product (GDP). The boost to nominal GDP growth is estimated at 0.6 percentage point over 12 months using fiscal multipliers, said Sengupta.

HDFC Bank’s Gupta said the reform could boost demand for consumer durables if GST rates on items such as ACs and TVs are reduced. “A more notable impact could also be seen for demand for two-wheelers and cars if the current GST rate of 28% is reduced to 18%,” she said.

Singhal highlighted that fast-moving consumer goods (FMCG) companies will see a positive impact, depending on how and when the changes are implemented.

You may also like

Major Premier League controversy as VAR strikes in Chelsea vs Crystal Palace

London street looks 'normal' until you spot tiny detail with unexpected twist

Chhattisgarh News: 4 Maoists With ₹19 Lakh Bounty Surrender In Gariaband

Vijay Deverakonda celebrates Independance Day at Times Square

Now, eco-tourism services go online in Himachal Pradesh